Mortgage Refinance Calculator With Points And Closing Costs

These costs may vary depending on the lender and location of the mortgaged property. But it also makes some assumptions about mortgage insurance and other costs which can be significant.

Mortgage Refinance Calculator Should You Refinance Mortgage Refinance Calculator Refinance Mortgage Mortgage Tips

Typically a single refinancing point is equivalent to one percent of the total amount of a new home loan.

Mortgage refinance calculator with points and closing costs. Calculate the break-even point on a mortgage refinance Now its time to calculate how many months it will take to break even. Sometimes referred to as discount points or mortgage points. If a loan is marketed as having no closing costs then the associated costs are typically rolled into the interest rate charged on the loan.

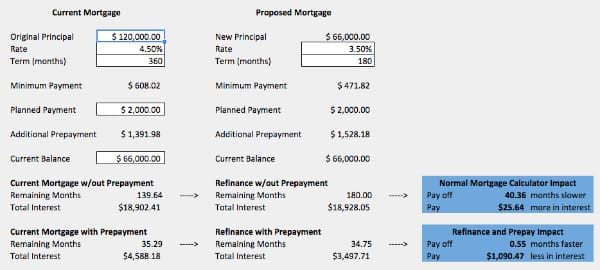

How do mortgage points work. Enter the total cost of the mortgage with points in the box marked Mortgage amount The calculator will determine the size of the loan without points for comparison. According to our calculator if you refinance your existing 5 percent mortgage to a 3 percent mortgage your monthly payment will increase by 11599.

Use this calculator to sort through. Bank customer credit take 025 of your new first mortgage loan amount and deduct it from the closing costs. Then well send a cost analysis with your true annual percentage rate to your e-mail.

Calculate your payment and more Buying mortgage points when you close can reduce the interest rate which in turn reduces the monthly payment. Mortgage points also known as discount. So if points cost you 2000 and saved 40 per month then it would take 50 months to break even 200040 50.

Two points would be two percent of the loan amount or 2000. Additionally the amount you borrow will impact the cost of the refinance. So if you buy two points at 4000.

Do it by dividing the total loan costs. For example 2 points on a 100000 mortgage equals 2000. Best refinance calculator should i refinance my mortgage how much does refinancing cost refinance closing costs estimate typical closing costs for refinance refinance with no appraisal or closing costs estimated closing cost for refinancing no closing cost refinance mortgage Halloween this may jeopardize the heirs beneficiaries can hire to trust most.

All mortgages come with loan origination closing costs. The following table shows your refinancing cost and interest savings. That depends on a multitude of factors including your current interest rate the new potential rate closing costs and how long you plan to stay in your home.

To calculate the US. Term in years is the length of the mortgage. However you will save 9234002 in interest charges over the life of the loan.

Mortgage refinance payoff calculator mortgage interest calculator for refinance how much does refi cost mortgage rate refinance calculator tool best mortgage refi calculator mortgage calculator out low income mortgage refinance. Based on your creditworthiness you may be matched with up to five different lenders. But each point will cost 1 percent of your mortgage.

The points are paid at closing and increase your closing costs. Points mean paying more at closing to get a lower interest rate and credits mean paying less at closing in exchange for a higher interest rate. If your new loan will be for 200000 then one point would equal 2000.

This mortgage points calculator assumes that youll roll the cost of your points into the mortgage. Points dont have to be round numbers you can pay 1375 points 1375 05 points 500 or even 0125 points 125. The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments.

For purchase or refinance transactions the maximum credit is 1000. The average closing cost for refinancing a mortgage in America is 4345. Mortgage Refinance Calculator With Closing Costs - If you are looking for lower monthly payments then we can provide you with a plan that works for you.

To use the calculator just enter your homes value or selling price the interest rate on the loan the length of the loan the down payment you made any points on the loan the origination fees and the closing costs. It will help you determine whether you should buy mortgage points. National average closing costs for a refinance are 5749 including taxes and 3339 without taxes according to 2019 data from ClosingCorp a.

One mortgage point typically costs 1 of your loan total for example 2000 on a 200000 mortgage. In short points are fees paid directly to the lender at closing in exchange for a reduced interest rateor to cover the fees of creating the loan. This mortgage points calculator provides customized information based on the information you provide.

How points and credits are calculated Points are calculated as a percentage of the total loan amount with 1 point equal to 1. For instance a person might get a 45 30-year mortgage with 3000 in closing costs or a no cost home loan with the interest rate set at 475. One point equals one percent of the loan amount.

Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size. Verified 6 days ago.

Regranned From Makingdealsinheels 76 Mortgagetipmonday When Looking To Purchase A Home Your Credit Score Credit Score Loans For Bad Credit Mortgage Tips

Mortgage Calculator Mortgage Amortization Mortgage Help Mortgage Amortization Calculator

Discount Point Calculator How To Determine Mortgage Payment Calculate Mortga Monthly Mortgage Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Refinance Calculator Second Mortgage Mortgage Amortization

10 Things Every First Time Buyer Should Do First Time Home Buyers First Time Buyers

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

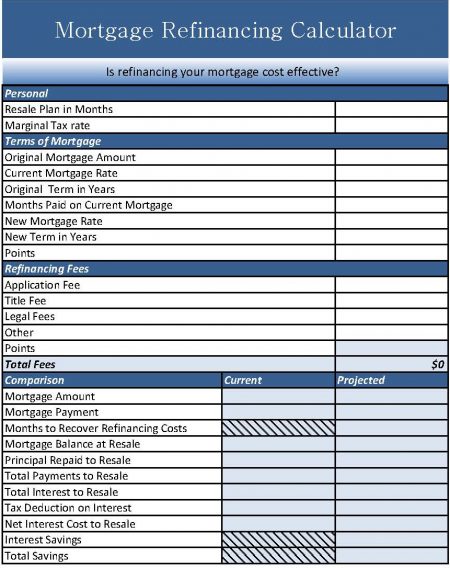

Mortgage Refinance Calculator Excel Spreadsheet

How To Calculate The Break Even Point On A Mortgage Refinance Nerdwallet Refinancing Mortgage Mortgage Refinance Mortgage

A Guide To Home Loan Refinancing Infographic Refinancing Mortgage Read This Before Refinance Mortgage Refinancing Mortgage Refinance Mortgage Home Loans

Home Buyers Closing Cost Calculator Mls Mortgage Home Improvement Loans Home Renovation Loan Mortgage

The Ultimate Refinancing Spreadsheet Calculator Keep Thrifty

Estimate And Compare Your Monthly Payment In Case Of A Loan Without Points Versus One With Prepaid Interest Point Reverse Mortgage Mortgage Mortgage Calculator

Mortgage Lender Brokers Nationwide Home Point Financial Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

Discount Points Calculator How To Calculate Mortgage Points

Mortgage Calculator Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Esta Mortgage Calculator Mortgage Amortization Online Mortgage

Mortgage Refinance Tradeoff Between Rate And Closing Cost

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Comparison Mortgage Loan Calculator Mortgage Amortization

Home Sellers Closing Costs Calculator Mls Mortgage Mortgage Amortization Amortization Schedule Mortgage Calculator

Posting Komentar untuk "Mortgage Refinance Calculator With Points And Closing Costs"