How Much Does Wells Fargo Charge To Refinance

52009 333 PM EDT By Phil Villarreal. Or you could pay off your mortgage faster by securing a lower.

![]()

Wells Fargo Mortgage Review 2021 Smartasset Com

You can also call us at.

How much does wells fargo charge to refinance. If you have a Wells Fargo mortgage you could be eligible for the Wells Fargo streamline refinance. How much can you borrow via Wells Fargo Student Loan Refinance. 8 am 2 pm.

Refinancing your home loan with Wells Fargo may offer much-needed relief in your budget. You can lower your monthly payments on your Wells Fargo auto loan and save 600 every year 50 every month through refinancing. The APR for a Wells Fargo home equity line of credit is variable and based on the highest prime rate published in the Western edition of The Wall Street Journal Money Rates table called the Index plus a margin.

The APR for a Wells Fargo home equity line of credit is variable and based on the highest prime rate published in the Western edition of The Wall Street Journal Money Rates table called the Index plus a margin. Wells Fargo currently charges up to 750 for a non-customer to cash a check drawn upon their bank without having an account. But again this amount will vary depending on the type of mortgage product and the property location.

The rate is 125 higher than what we could get doing a regular refinance but then we would have to pay closing costs. Interest rates may change many times every day. Your closing costs which will depend on your lender type of mortgage and home location may cost thousands of dollars theyre typically 2 to 5.

The benefit of a streamline refinance is that a borrower does not have to provide as much credit documentation and the underwriting is limited. The index as of the last change date of March 16 2020 is 325. Loans with fixed rates will typically have higher APRs than loans with a variable rate.

Mortgage refinancing can change your loanto meet your needs. Wells Fargo Will Let You Refinance For No Closing Costs Online. There are no upfront costs to refinance with Wells Fargo.

Our simplified online application makes refinancing your home loan easy to get started. How much will I pay to refinance with Wells Fargo. As of April 24 2020 margins range from 4250 to -0225 for lines of credit from 25000 to 500000 secured by.

During closing youll need to review and sign loan and other paperwork to finalize the home purchase process as well as pay some upfront costs. For many of its mortgage products Wells Fargo charges a processing fee of 1225. There is also a Wells Fargo check cashing limit of 2500 for non-account holders.

The index as of the last change date of March 16 2020 is 325. Streamline refinance refers to the refinance of an existing FHA-insured mortgage. Were not positive were going to stay in this house for more than a couples years so it seemed like a good deal.

Wells Fargos loan-to-value maximum is quite generous at 80. In fact they make it easy to check what rates and terms you might qualify for with no impact to your credit score by filling out a quick online form. Ask your home loan consultant for the specific fees associated with your mortgage and keep an eye out for additional fees in your loan documentation.

Wells Fargo Student Loan Refinance offers variable rate APRs that range from 449 to 949. Borrowers who choose a fixed-rate refinancing loan can expect APRs that range from 624 to 1099 APR. When you lock your rate we apply a specific range of interest rates to your loan application that are available at the date and time of your rate lock.

This is how it was explained to me by Wells Fargo but I was wondering if there were any hidden costs. These are sample rates based on assumptions. As of April 24 2020 margins range from 4250 to -0225 for lines of credit from 25000 to 500000 secured by.

Mortgage online banking advice wells-fargo homes refinancing runaround. The streamline option can be a. This includes all charges other than discount points that lenders and brokers involved in the transaction will receive for originating the loan.

You are a great candidate for refinancing if a you got. Apply for a mortgage online. Wells Fargo has five different types of checking accounts.

In other words if Wells Fargo was issuing 30-year mortgage refinances at 500 percent rates a Wells Fargo jumbo refi would be just 525 percent. Interest rates for mortgages below may include up to 05 discount points as an upfront cost to borrowers. What does a streamline refinance mean.

Current Mortgage and Refinance Rates. Please call us at the phone number found on your monthly loan statement if you need more information about fees charges and costs. The origination charge is the amount charged for services performed on the initial loan application and loan processing.

Rates for refinancing assume no cash out. Other perks include its convenient tools for homeowners seeking ways to refinance their home with calculators and handy how-to guides available on the banks website. It includes any fees for application processing underwriting services and payments from the lender for origination.

We hold this range of rates for a designated length of time known as your rate lock period. Your needs can change so can your mortgage loan. 6 am 10 pm.

Refinance Your Home Loan with Wells Fargo.

Wells Fargo Auto Loan Review For 2021

Wells Fargo Active Cash Review Nerdwallet

Manage Your Account Wells Fargo

![]()

Small Business Product List Wells Fargo Business Credit Cards

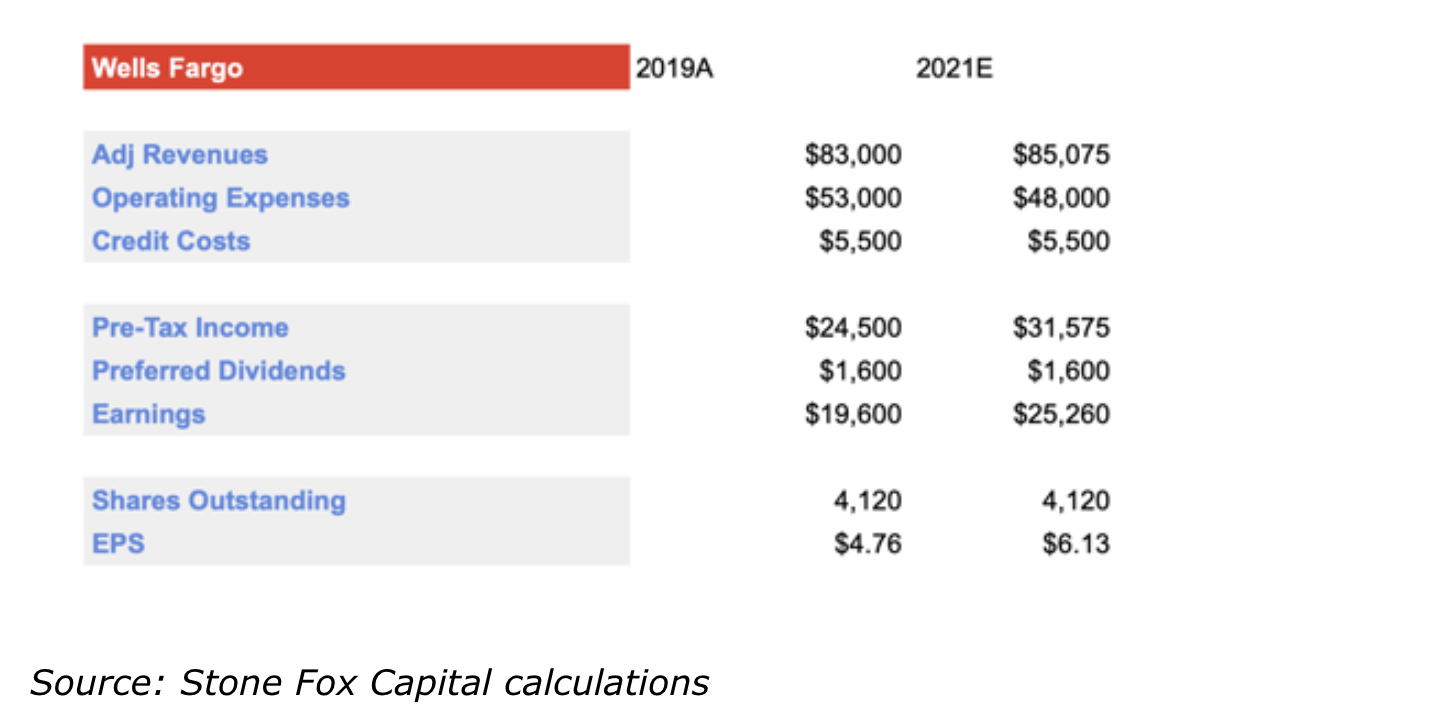

Wells Fargo Asset Cap Pain Nyse Wfc Seeking Alpha

Review Wells Fargo Home Mortgage The Ascent

Wells Fargo Mortgage Review 2021 Smartasset Com

30 Year Mortgage Rates Today Wells Fargo

Financing For Small Business Wells Fargo

How The Loan Modification Process Works

Wells Fargo Home Mortgage Welcome

Wells Fargo Mortgage Rates See This Week S Rates Smartasset Com

The Wells Fargo Wfc Fake Accounts Scandal Continues To Take Its Toll On The Bank Quartz

Wells Fargo Personal Loans Review 2021

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Unsecured Home Improvement Loan Wells Fargo

Wells Fargo Lays The Groundwork For Emea Cib Push

Wells Fargo Home Mortgage Lender Review 2021 Nextadvisor With Time

Posting Komentar untuk "How Much Does Wells Fargo Charge To Refinance"